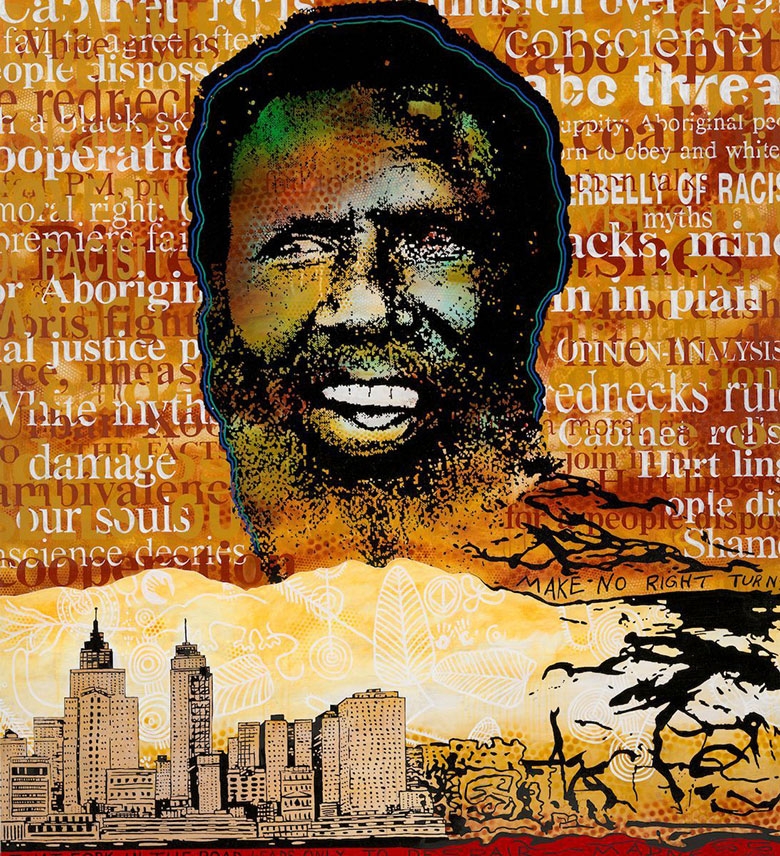

Standing up tall for Noongar

Perth, Western Australia: Conceived, created and performed by members of Yirra Yaakin Theatre Company with respect for the community, elders and ancestors, the play Hecate powerfully meets the corporation’s objective as a cultural caretaker—ultimately, to ‘improve the cultural health of all involved and find space for an Aboriginal voice to be heard’. As if that wasn’t reason enough to celebrate, there are also layers of insights in this story for aspiring leaders of all corporations.